Costs plummet, offering hope for reducing use of fossil fuels

There is no shortage of bad

green-energy news. Automakers are fretting about electricvehicle growth, higher interest

rates are smashing financial

plans, permitting for big projects still takes forever and offshore wind is a mess.

But for every setback, there

is a Sun Streams. This cluster

of solar farms will cover more

than 13 square miles of desert

west of Phoenix. By 2025, it

will provide enough electricity

for roughly 300,000 homes,

bringing Arizona’s largest utility closer to its goal of a zerocarbon grid.

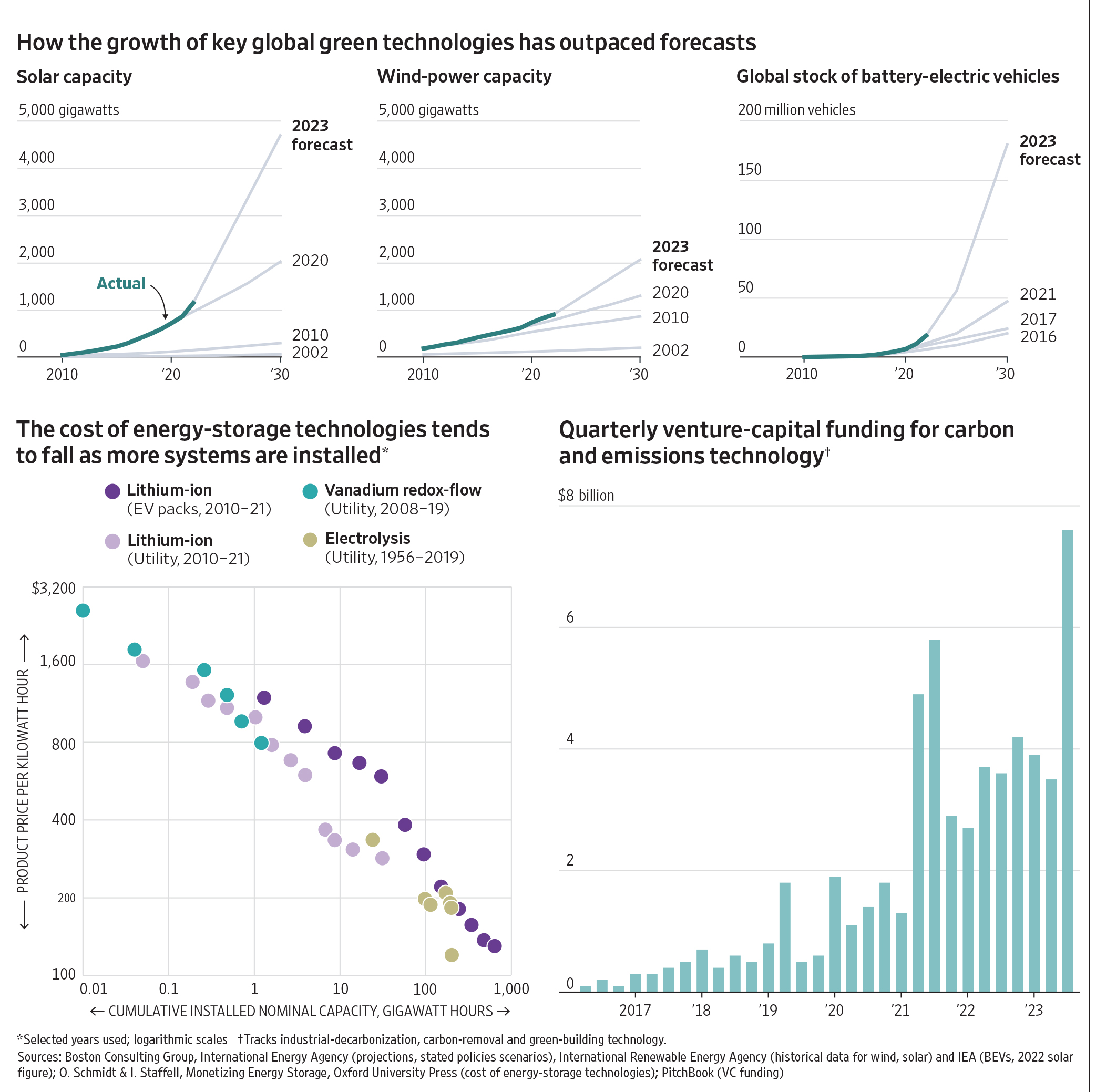

The scale of the development, mostly owned by renewables company Longroad Energy, is part of a staggering

surge in renewable energy.

Driven by falling costs and

better technology, growth in

renewables has consistently

exceeded expectations.

The annual United Nations

climate summit starts later

this week in Dubai. What has

become clear after years of

talking is that few countries,

businesses or people are willing to sacrifice much to limit

climate change. The explosion

of clean energy offers hope for

cutting fossil-fuel use.

“We are coming short on

many dimensions, and we

have an enormous amount of

work to do,” said Rich Lesser,

global chair of Boston Consulting Group. “But, equally important, our ability to make

progress on the technology

side has dramatically exceeded

our expectations.”

In 2009, the International

Energy Agency predicted that

solar power would remain too

expensive to compete on the grid. It continued to underestimate the growth of renewable energy and EVs. Last

year, more than four-fifths of

the world’s new power capacity was renewables, according

to the International Renewable

Energy Agency.

Subsidies drove early

growth in wind and solar, then

technology refinements and

large-scale manufacturing

made them cheap. Lithium-ion

batteries, which power cars

and store electricity on the

grid, plunged in price, too. Sun

Streams will have enough batteries to power about 40,000

Teslas.

Money is continuing to flow

into these projects despite

green energy’s headwinds.

Longroad, the developer, said

it raised $600 million of debt

finance to expand its portfolio

in a deal led by Apterra Infrastructure Capital, an affiliate

of Apollo Global Management.

Research firm Rystad Energy estimates that we are on

course to burn enough oil, gas

and coal to heat the planet by

between 1.6 degrees and 1.9

degrees Celsius above prein dustrial levels, depending on

how urgently governments act

to speed up the transition.

That is rosier than many

other forecasts, though it exceeds the international target

of 1.5 degrees that is seen as a

comparatively safe limit.

Rystad’s bullishness comes

from the sun. Chief Executive

Jarand Rystad said the spread

of solar panels is compensating for lagging sectors such as

offshore wind, which has been

hobbled by cost overruns and

snarled supply chains.

BloombergNEF expects solar

panels installed this year to

add nearly 400 gigawatts of

generating capacity. That is 4.5% of the generating capacity

of the world’s power plants in

2022. On the current trajectory,

transition bulls argue, it is a

matter of when renewables

erode fossil-fuel use, not if.

The IEA expects demand

for coal, gas and oil to peak

this decade. Many fossil-fuelproducing companies and

countries are betting on a long

future for their products, and

peak-oil talk has been wrong

before.

But it is also easy to underestimate the pace of change.

Projections by the U.S. Energy

Information Administration

didn’t see how quickly renewable energy and natural gas

would erode U.S. coal consumption.

Much depends on China,

where the growth of wind and

solar coincides with new coal

projects. Optimists say coal

plants will act as backup in a

system increasingly dominated

by renewables. China leads the

world in long-duration battery

projects, according to

BloombergNEF.

Jarand Rystad said fossilfuel power generation in China

is close to a peak. “The tipping

point is very soon,” he said.

The average cost of solar

power fell nearly 90% between

2009 and 2023, with onshore

wind declining by two-thirds,

according to BloombergNEF.

Similar declines are starting to reshape transportation.

EV costs are falling, and infrastructure is improving. The total cost of ownership of small

and midsize EVs is cheaper

than gasoline-powered vehicles in China and Europe and

could hit that point in the U.S.

next year, according to the

Economics of Energy Innovation and System Transition

project led by the University

of Exeter.

In this view, renewables,

batteries and EVs will become

more popular as they get

cheaper and better. Emerging

green-energy technologies

such as hydrogen, which is

benefiting from government

support and a surge in private

investment, could follow the

same path.

Investors including Singapore state investment company Temasek put up €1.5 billion, or about $1.64 billion, for

a low-carbon steel plant in

Sweden in September as more

money flows into decarbonizing industrial processes.

Thorny emissions problems

now have competing possible

solutions. Startup Boston

Metal recently raised $262

million to make green steel via

a method that uses electricity

rather than hydrogen. Two

others, Rondo Energy and Antora Energy, are manufacturing thermal batteries that

store electricity as heat—a

way to power high-temperature processes while using up

surplus renewable power.

“The fact that solar and

wind costs have come down so

dramatically has opened up a

whole new set of options,”

said Dolf Gielen, an energy

economist at the World Bank.